Live Event

KPMG RegTech Conference 2026

Digital fraud evolution, KYC, Market Abuse, AI in Compliance and its use cases. Live at the KPMG RegTech Conference, April 16, 2026

Compliance

Financial Institutions/FinTech

09.01.2025|

Day in and day out, banks and financial service providers work to keep their customers safe and secure. A key part of this effort involves analyzing customer identities and assessing risks to prevent money laundering, fraud, and other financial crimes. This means checking customer data against sanctions lists, PEP (Politically Exposed Persons) lists, and adverse media, as well as any custom watchlists. Customer screening is an integral part of the Know Your Customer (KYC) process, ensuring thorough due diligence.

Customer screening has gained new momentum with instant payments. However, daily screening of customer data comes with its own challenges.

The Instant Payment Regulation (IPR) mandates that payment service providers (PSPs) be equipped to handle real-time transfers starting in January 2025, provided they check customer data against sanctions lists at least once daily.

Customers expect their PSP to provide reliable instant payments. Any disruptions can lead to significant frustration. The challenge lies in finding the right balance between meeting customer expectations and ensuring institutional security.

Are you a compliance professional in a bank or insurance? Then you certainly wish to have as few false positives as possible when screening your client base against sanctions and PEP lists, adverse media lists and internal company lists.

Automatically reconcile customer data with sanctions, PEP, and adverse media lists, deploy machine learning and reduce false positives.

Over and above instant payments alone though, screening customers is important for other reasons. It’s a key way to help prevent money laundering, for example. Companies that are regulated must check customer data when they first start doing business with someone, then regularly screen the entire customer base against sanctions and PEP lists.

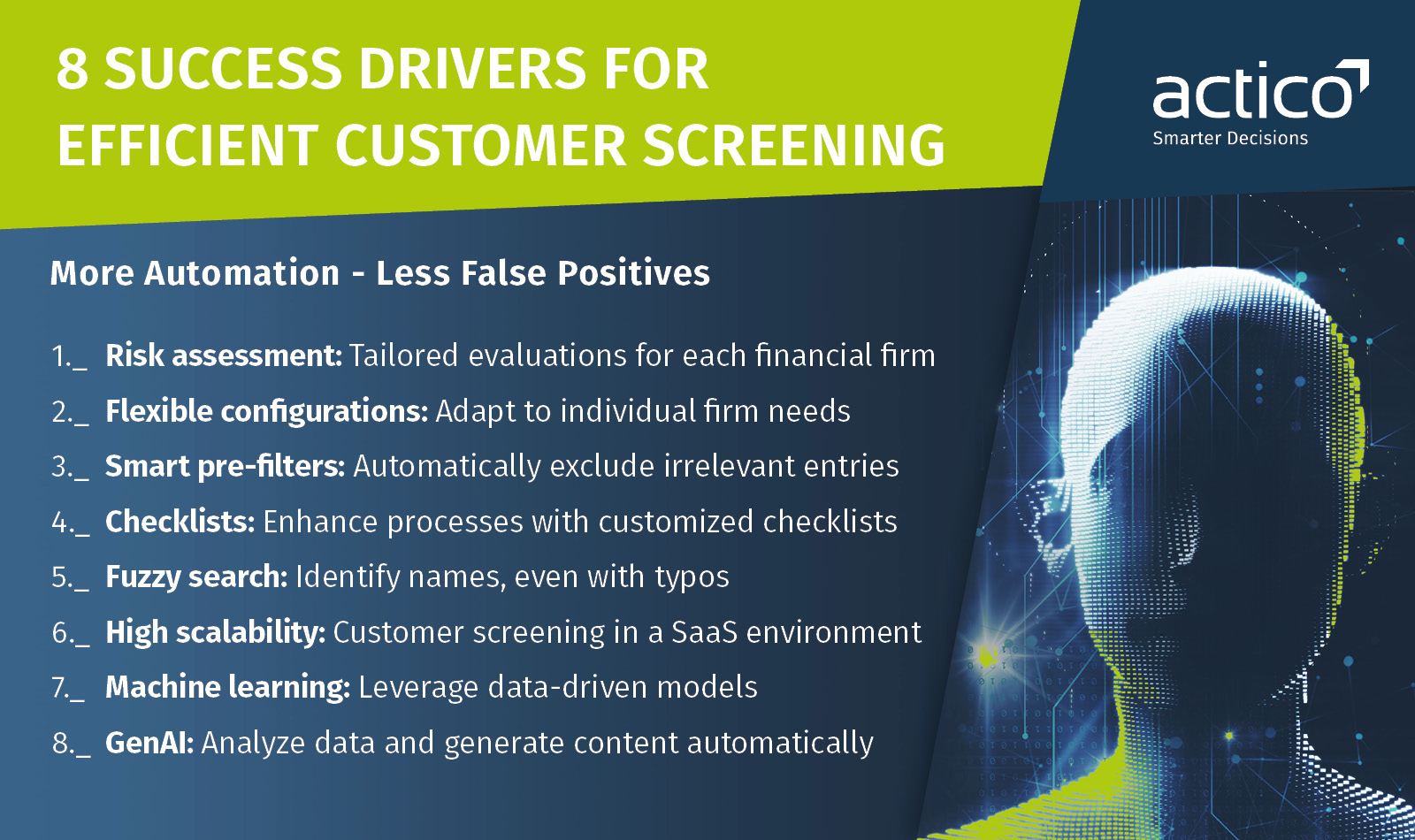

This isn’t new, but customer screening is now a big part of making compliance more efficient. If the software is set up right, it’ll show as few false positives as possible, so compliance teams can focus on the real cases, the true positives. But how do they get there?

Regulated entities have to scrutinise new and existing customers as part of their Customer Due Diligence (CDD) process. This multi-faceted approach encompasses Know Your Customer (KYC) identification and regular cross-checking of customer data against sanctions, PEP and adverse media lists.

The Instant Payment Regulation IPR mandates that payment service providers screen their customers against these lists at least once per day. This ensures that clients sending or receiving real-time transfers aren’t flagged on any watchlists.

The challenge for payment providers? Manual checks simply aren’t feasible with instant payments. Instead, the payment system must automatically halt transactions the moment a customer’s details match a sanctions list entry. False positives frustrate customers and create additional work for banks. The solution? Sophisticated algorithms, tailored configurations and ML models that dramatically reduce false positives.

Customer screening takes centre stage when it comes to instant payments and anti-money laundering. Get a robust screening system in place and you enhance efficiency, slash costs and bolster your competitive edge. The keys to success? Customer satisfaction, ironclad compliance risk management and the judicious deployment of compliance personnel.

You may also be interested in:

Live Event

KPMG RegTech Conference 2026

Digital fraud evolution, KYC, Market Abuse, AI in Compliance and its use cases. Live at the KPMG RegTech Conference, April 16, 2026

Compliance

Financial Institutions/FinTech

Report

Gartner® Magic Quadrant™ for Decision Intelligence Platforms 2026

ACTICO named a Leader in the first ever 2026 Gartner® Magic Quadrant™ for Decision Intelligence Platforms. Explore the full report.

Advanced Decision Automation

Awards & Recognitions

News

Turning Decisions into Impact: ACTICO Recognized as a Leader in Gartner® Magic Quadrant™ for Decision Intelligence Platforms

An independent Gartner evaluation of 17 vendors across 15 Critical Capabilities in decision intelligence.

Advanced Decision Automation

Awards & Recognitions

News

ACTICO awarded “Leading Decisioning Platform 2025” at the 21st Elets NBFC 100 Tech Summit

ACTICO has been recognised as the Leading Decisioning Platform 2025 at the Elets NBFC 100 Tech Summit, highlighting scalable, high-performance credit decisioning for NBFCs and financial service providers across APAC.

Retail Credit Decisioning

Non-Banking Financial Company

Awards & Recognitions

Newsletter

Regular News and Updates

Decision Management Platform

Compliance

Resources

You are currently viewing a placeholder content from Wistia. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information