When calculating AML risks, various factors are taken into account—including customer risk (e.g. PEP status), product risk, transaction risk, country risk, and the risk associated with distribution channels.

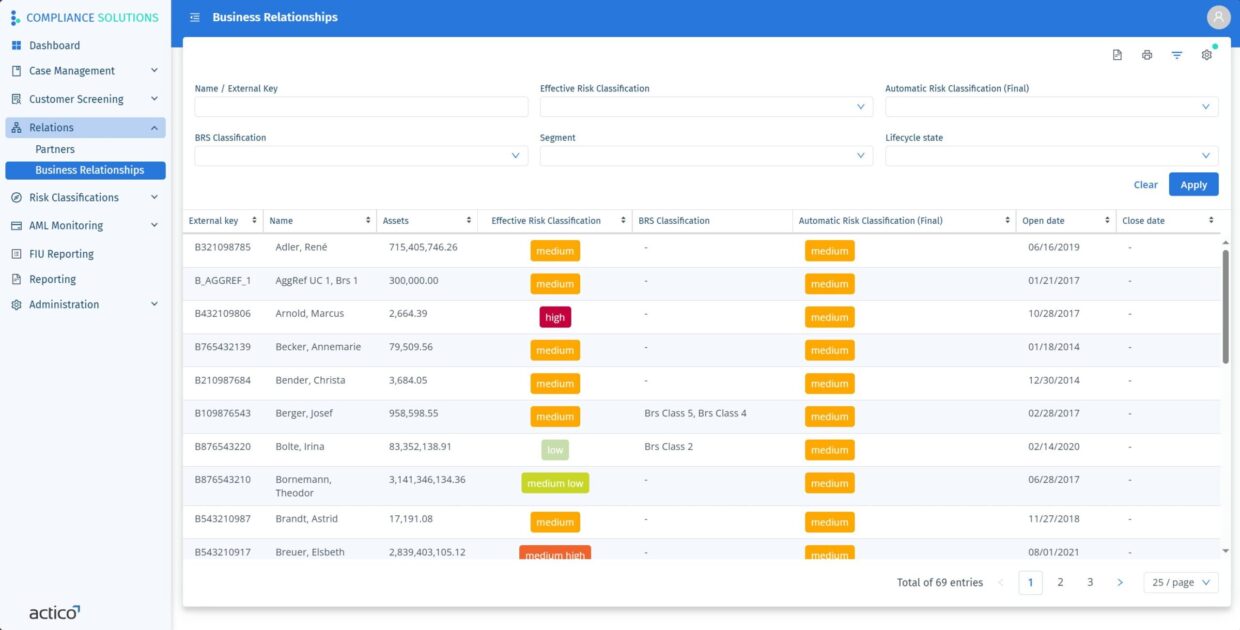

Even broader sets of information can further enhance risk assessments. These may include partner details, business relationship structures, geographical data (such as countries of residence or nationalities), and external sources like customer screening results.

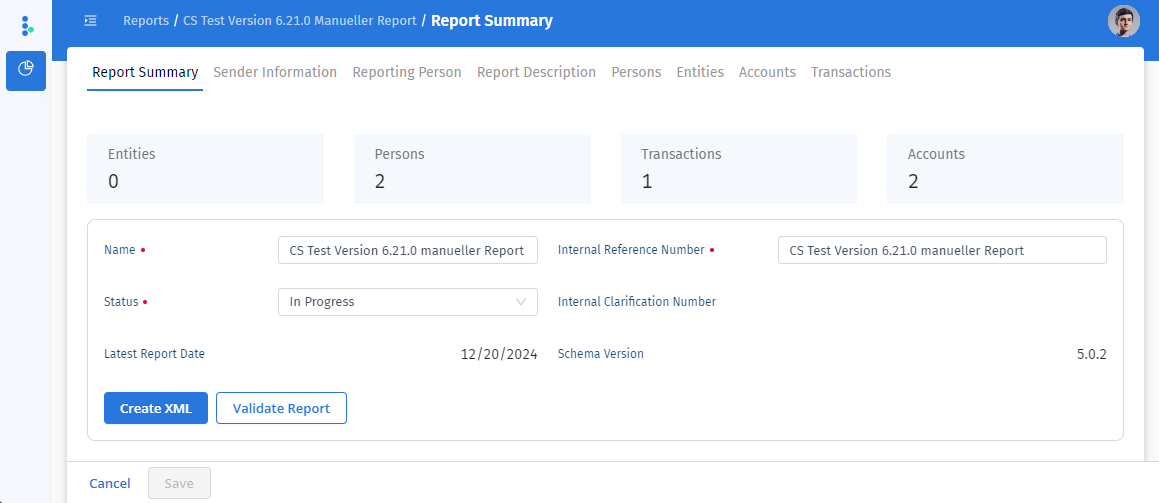

At ACTICO, business relationships are assigned a risk level based on these factors. While the risk level is generated automatically, it can be adjusted manually where needed. Key elements such as source of wealth, expected transaction volume, deposit levels, and the origin of assets can also be included. Users can easily define additional custom risk factors to tailor the model precisely to their needs. In exceptional cases, analysts can manually assign a specific risk classification.