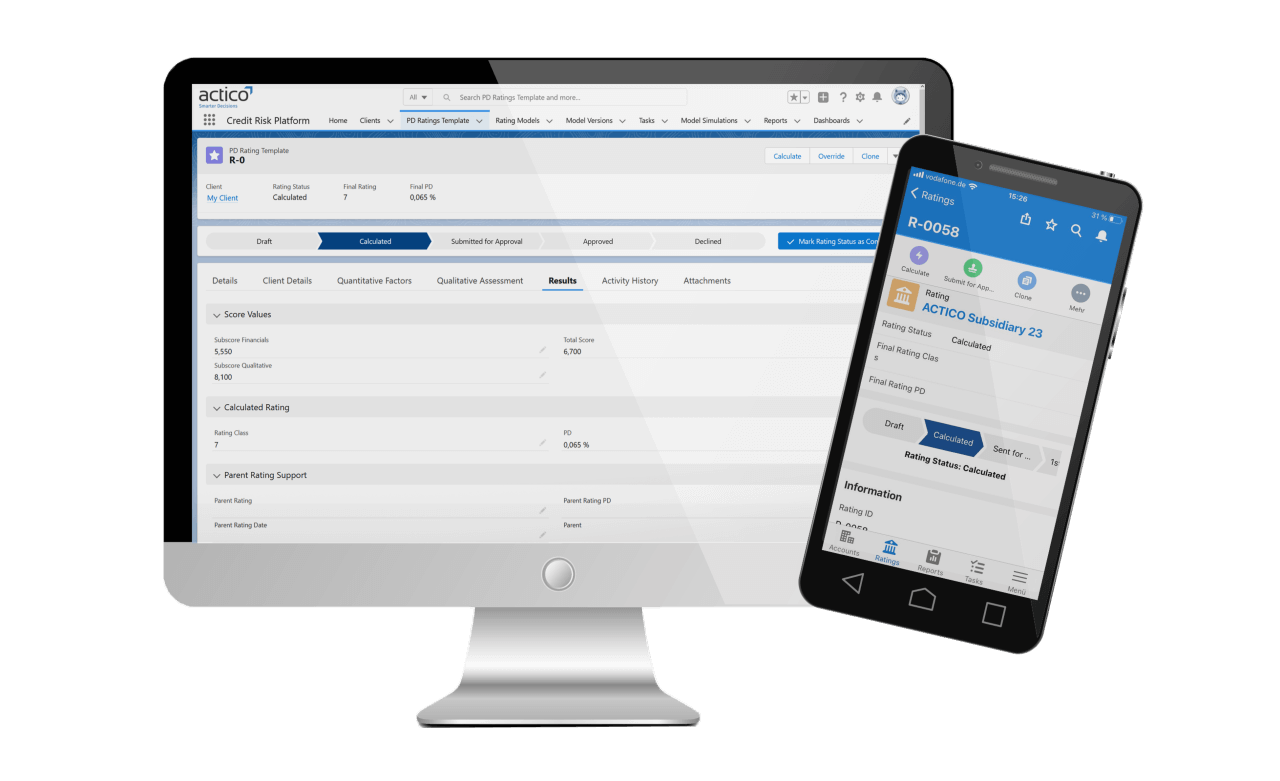

“ACTICO provides the bank with an integrated system for all rating models that comprehensively supports our credit analysts during the rating workflow.”

Dr. Stefan Krohnsnest

Head of Risk Controlling, DZ Hyp

Evaluate, manage, and minimise potential credit risks while streamlining your decision-making processes. Explore the Credit Risk Management Software from ACTICO.

Credit risk management is, and will remain, the focus of intense regulatory scrutiny. To comply with stricter regulatory requirements, credit institutions overhaul their credit risk management approaches. Yet, viewing this as merely a compliance exercise is short-sighted. Improved credit risk management fulfils regulatory requirements and provides an opportunity to improve overall performance and secure a competitive advantage.

Banks must implement an integrated, quantitative and qualitative credit risk solution to reduce loan losses and ensure that capital reserves accurately reflect the risk profile. The solution should enable banks to get up and running quickly with straightforward portfolio measures and also provide a path to more advanced credit risk management measures as needs change.

Agentic AI marks the next evolution beyond Generative AI. Instead of executing single prompts, agents autonomously perform complete tasks – from data collection to analysis. For credit risk teams, this means fewer manual steps, faster decisions, and greater consistency.

Discover in this Business Insight how Agentic AI transforms credit risk workflows and what prerequisites are key for its use in regulated environments.

“ACTICO provides the bank with an integrated system for all rating models that comprehensively supports our credit analysts during the rating workflow.”

Dr. Stefan Krohnsnest

Head of Risk Controlling, DZ Hyp

Take control of credit risk, compliance requirements and regulatory demands. Enjoy the flexibility and scalability of features like real-time risk model updates, user permission controls and seamless connections to your internal and third party systems.

Start the digital transformation of your credit risk management now!

ACTICO is designed to meet the specific demands of your market, business, and customer needs. It addresses current industry-specific issues while being adaptable to future challenges.

ACTICO empowers your team with a user-friendly, drag-and-drop tool that eliminates the need for coding, offers flexibility, and sets industry standards – regardless of the industry you are in. A credit risk decision-making software that is tailored to manage your risks – not those of others.

You may also be interested in:

Demo Video

Demo Video: ACTICO Credit Risk Platform

See how the ACTICO Credit Risk Platform enables faster, more reliable credit decisions in commercial and corporate lending — from automated financial spreading to integrated rating workflows

Commercial Credit Risk Assessment

Commercial & Corporate Banking

Demo Video

Demo Video: ACTICO Financial Statement Analysis

See how ACTICO simplifies financial statement analysis – helping credit analysts gain insights faster, improve data transparency, and enhance credit decision quality.

Financial Spreading

Commercial & Corporate Banking

News

Chartis Research rates ACTICO’s Watchlist and Adverse Media Monitoring highly across all six categories

Chartis Research awards top marks to ACTICO’s software for sanctions screening and adverse media monitoring.

Compliance

Awards & Recognitions

Report

Chartis Research rates ACTICO’s Watchlist and Adverse Media Screening highly across six categories

Chartis Research has profiled ACTICO’s software for sanctions, PEP, and adverse media screening — the key findings are summarized in the spotlight.

Compliance

Financial Institutions/FinTech

Newsletter

Regular News and Updates

Decision Management Platform

Compliance

Resources

You are currently viewing a placeholder content from Wistia. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information