How important is efficiency and effectiveness in payment screening, and what exactly is the difference?

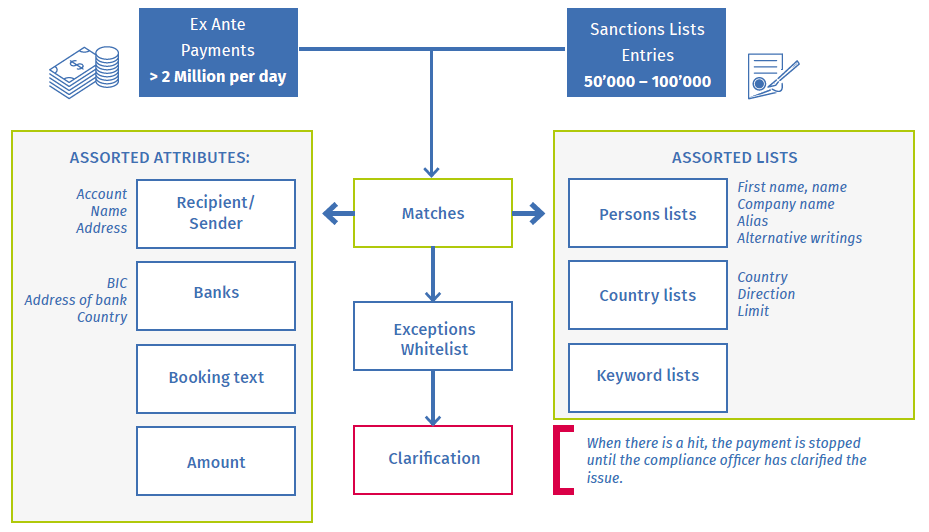

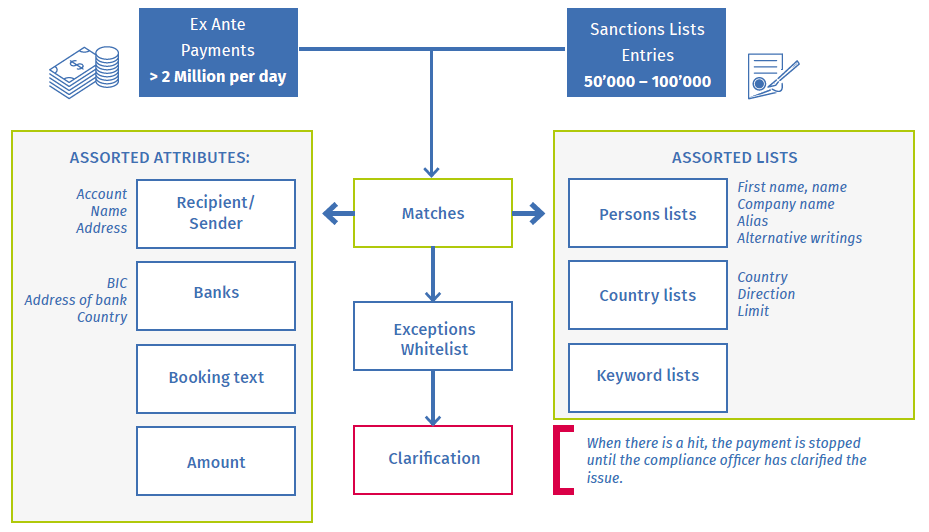

During the screening process, the payment screening software checks payment data against sanctions lists, embargo lists and other blacklists. This data matching is based on criteria such as first and last name, company name, alias name, alternative spellings, countries involved, banks, BICs, accounts, amount, keywords and whitelist exceptions. Financial institutions are under increasing pressure to ensure their systems are both efficient and effective.

Effectiveness: How good is the system at identifying risky payments?

If a hit, i.e. a potential match to a sanctions list entry, is discovered during payment screening, this process has to be clarified manually. Banks can’t afford to miss anything – failure to spot a suspicious payment could entail serious legal and financial consequences.

Banks usually carry out effectiveness tests every year using predefined test cases. These check whether the system is identifying the hits it has to find in order to ensure compliance. These tests are usually done using test data rather than real data to avoid confidentiality issues.

They are normally conducted by independent third parties such as management consultancies and auditing firms. They use benchmarks from several institutions to compare a bank’s payment screening performance against that of their peers.

Efficiency: How accurate is a hit? Is it a false positive or a true positive?

The efficiency test examines how much work a hit generates when screening a payment. Every hit has to be reviewed by a member of the compliance team, who decides whether the name that appears on the payment is actually the person on the sanctions list. The percentage of true positives, i.e. hits that represent a real threat, should be as high as possible. This is because unnecessary hits (false positives) increase the workload of compliance staff without posing an actual risk. The efficiency of a system depends on finding the fewest possible false positives.

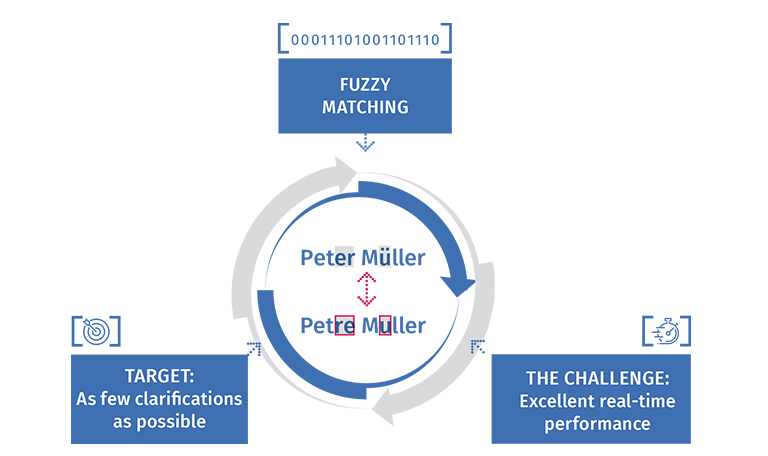

The fact that sanctions lists are growing longer and banks are regularly screening transactions increases the likelihood of false positives, for example when customers have an identical or similar name. Processing every hit requires time and money, which is why banks are working hard to improve the efficiency of their payment screening systems.

Striking the right balance between effectiveness and efficiency – a tricky business

Achieving the twin goals of effectiveness and efficiency in payment screening is rarely easy because it is always a trade-off between risk and cost. On the one hand, the system has to identify every risky transaction for compliance reasons. But on the other, banks want to save money by handling as few clarifications as possible.

Machine learning has delivered tangible results in practice, helping to achieve an optimal balance of effectiveness and efficiency. This is evident at VP Bank Group, which has reduced manual effort by around 50% using fuzzy matching.