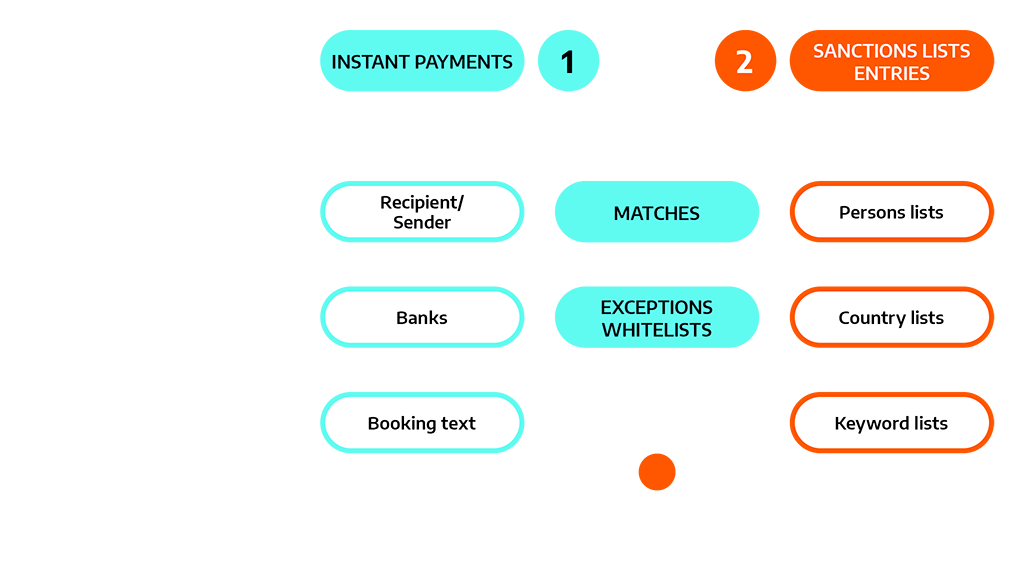

Right out of the box, the numerous configuration parameters included in ACTICO allow us to implement new requirements faster, eliminating the need for extensive customization.

Dr. Michael Sendker

Head of the Compliance Digitization Project, Hamburg Commercial Bank