Streamlining Decision Rule Modeling

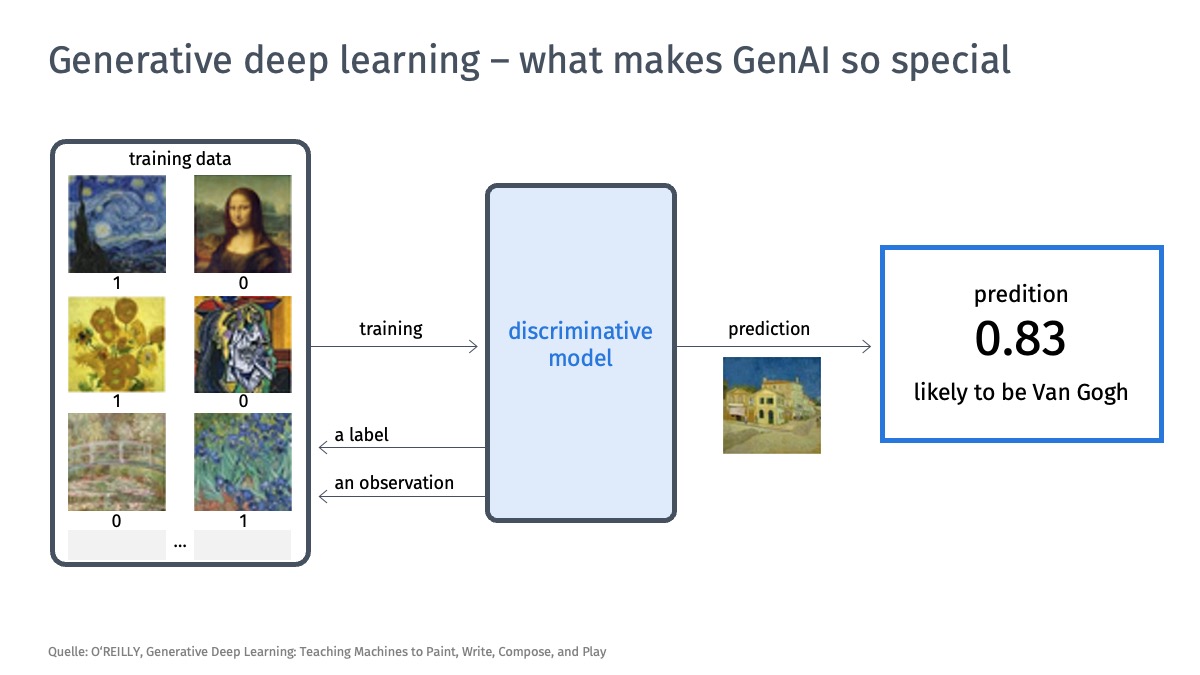

Modeling rules for automated credit approvals or other business decisions is a core feature of digital banking. With a new generative AI-based function integrated into the ACTICO Modeler, financial institutions will be able to significantly speed up this complex process. Instructions in natural language are sufficient to implement target specifications or optimize existing rule sets, making it easier to continuously adapt decision models to market dynamics.

The ACTICO Modeler will offer an input interface where requirements for the model can be formulated in natural language. The software then automatically translates the instructions into a detailed rule set. Alternatively, the requirements can be matched step-by-step with the decision tree settings in a guided dialog.

The ACTICO Modeler maintains access to an extensive collection of proven rule models. The choice of which model to use and its business requirements are always transparent.

The instructions for the AI can be given in any standard browser. The seamless interaction between the underlying language model and rule creation in the ACTICO Modeler is ensured by the ACTICO Cloud, based on the robust infrastructure of AWS.

Financial institutions will benefit from the integration of Generative AI in three ways.

First, it makes changing complex rule models more accessible to teams whose expertise lies in analysis rather than modeling. There’s no need to bring in specialized experts.

Second, this boosts efficiency. Besides reducing the need for personnel, the time required decreases as well. Automatic modeling significantly shortens the time until new decision rules are applicable.

Third, it enhances innovation capability. New target groups and financial products can be addressed more easily and successfully when decision models can be intuitively backed and optimized without significant lead time.