Decision Management in Anti Money Laundering

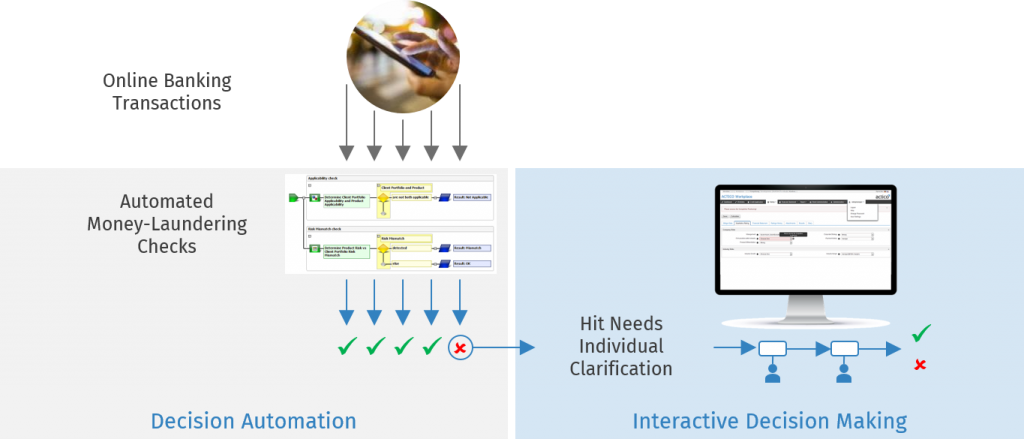

The online banking of a financial institution executes millions of transactions a day. The bank checks all these transactions for money laundering. It uses predefined decision models or machine-learning algorithms to detect suspicious behavioral patterns, words or risky countries. The decision as to whether a transaction is suspicious is fully automated (Decision Automation, scenario 1).

Among the multitude of online banking transactions, a suspected case has now been identified. The bank now wants to shed more light on this case. This is where interactive decision-making comes into play (scenario 2). The transaction is handed over with all the relevant data to an employee who examines the individual case once again. The employee can then approve the transaction if it was okay or, if the suspicion is confirmed, take further action.