FATF recognizes Switzerland’s progress in strengthening its AML/CTF measures

The fourth FATF Enhanced Follow-up Report published in October 2023 analyses the progress assessed to remedy some of the technical compliance shortcomings identified in its MER. Eight of the 40 recommendations are now marked as “compliant” (C). 29 as largely compliant (PC). Three recommendations are classified as “partially compliant” (PC).

In October 2024, the FATF concluded the fourth round of mutual country evaluations. This peer-to-peer evaluation analysed the measures taken by over 200 member countries to tackle financial crime, terrorist financing and proliferation. The Mutual Evaluation Reports (MER) analyse the respective progress made by each country, but also reveal their weaknesses.

With the start of the 5th round of evaluations, Switzerland and thus MROS also began the preparatory work for the evaluation of Switzerland. The State Secretariat for International Finance (SIF) has the lead in coordinating these activities.

The next FATF mutual evaluation of Switzerland is expected to take place in 2027/2028.

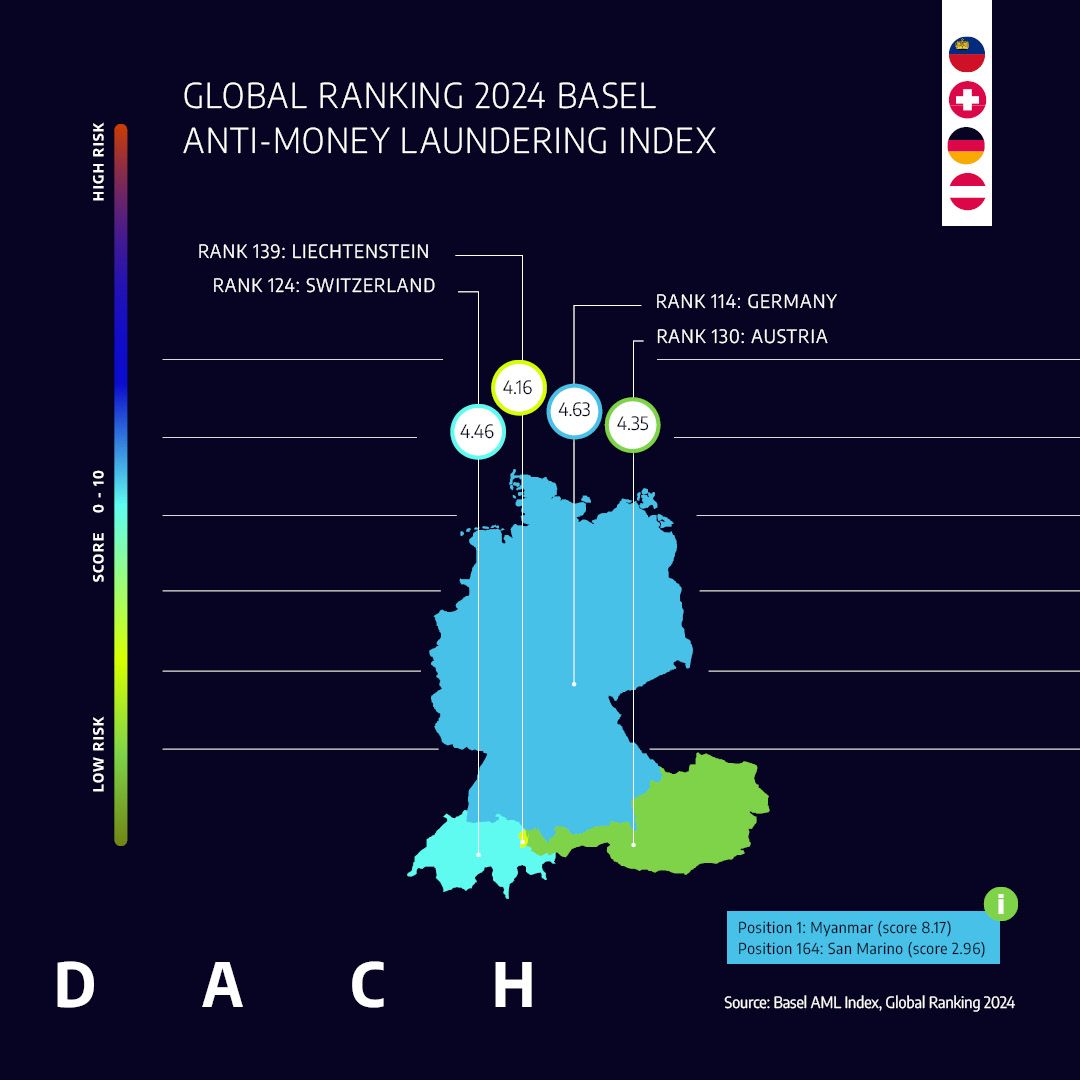

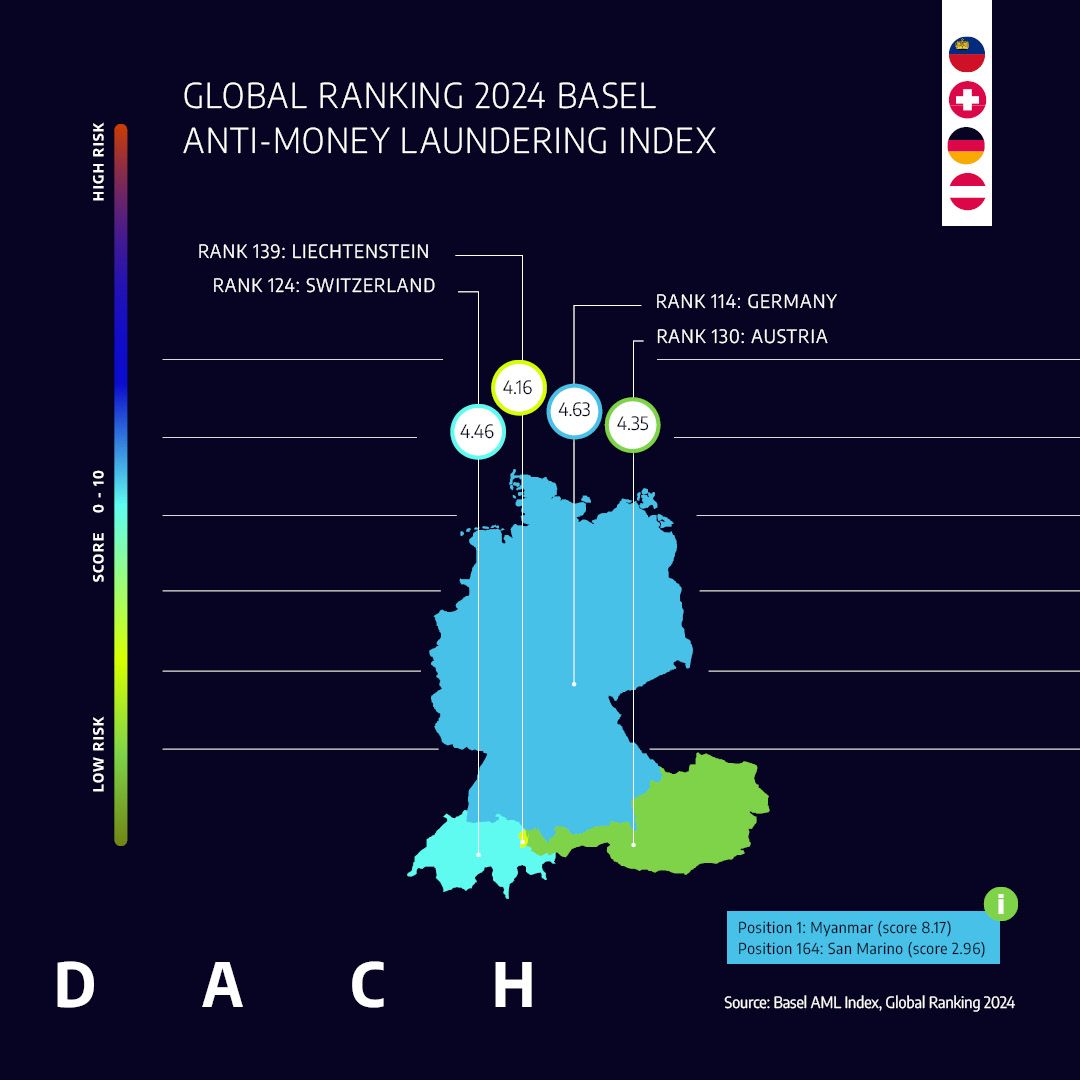

Basel Anti-Money Laundering Index: Assessing Money Laundering Risks Worldwide

The Basel AML Index measures the risk of money laundering and related financial crimes in countries and jurisdictions around the world. It uses a composite methodology, with 17 indicators in five domains in line with key factors considered to contribute to a high risk.

Out of 164 countries, San Marino received the highest rating in 2024. At the very bottom, in position 164, is Myanmar. Switzerland ranks 124th, while Liechtenstein ranks 139th.